New service! How to invest with InRento via Paysera?

What is InRento

InRento, now available on the Paysera super app, is a buy-to-let crowdfunding platform. It offers an opportunity to invest in various projects, including short-term rental accommodations, co-living spaces, and hotels.

One of the best parts is that if you're already a Paysera user, there's no need for extra identification – you've already completed that step when you signed up. Not to mention the convenience of managing both your finances and investments all in one app!

So how does the investing part work?

It’s simple, really. You can add property investments to your portfolio by checking the carefully selected projects located in Europe. Once you choose the project you like and invest in it, you can start earning monthly rental income. To make sure that everything is safe and simple, InRento links real estate companies with investors, so you don’t have to worry about small tasks that take extra time – all the information you need is already at your disposal.

Check out this blog post from InRento for more details about the InRento platform and how it works.

Who can use InRento?

Paysera clients with a verified Paysera account and Paysera super app installed on mobile – it works on iOS and Android. If you don’t have a Paysera account yet – you can open it for free without even going to a physical branch. Download our app now and enjoy!

Please keep in mind that you can only use this new feature if you're from one of the countries listed below.

What’s the minimum amount to invest?

You can invest in a project with a minimum of 500 euros or more.

Is it safe?

Both Paysera and InRento are authorised and regulated by the Bank of Lithuania, meaning that we follow all the necessary rules to protect you. Another safety measure is the previously mentioned fact that InRento selects potential projects for you to invest in very thoroughly and carefully.

How to start investing with InRento via Paysera?

- Log in to the Paysera app and select More in the bottom right corner;

- Scroll down until you see InRento and tap on it;

- Select START;

- Select the payment account, review the information, and tap ALLOW.

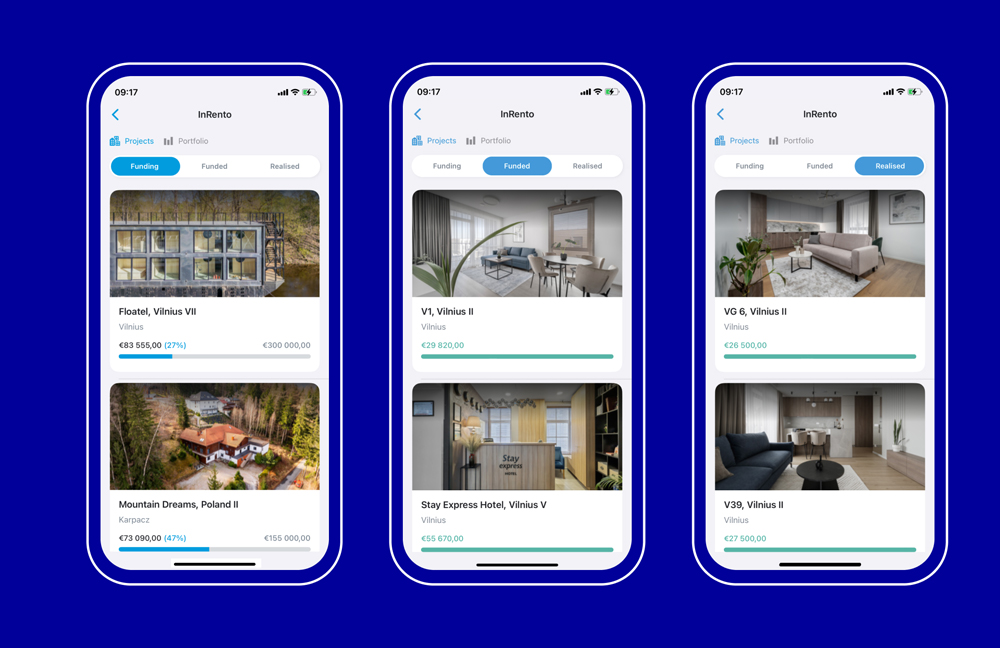

Once you’re there, you’ll see the wonderful projects that you can invest in, the already funded projects, realised projects, as well as the information about where a specific project:

- is located;

- the total amount of needed investment for the project to be realised;

- the amount of money that is already invested.

If a specific project catches your eye

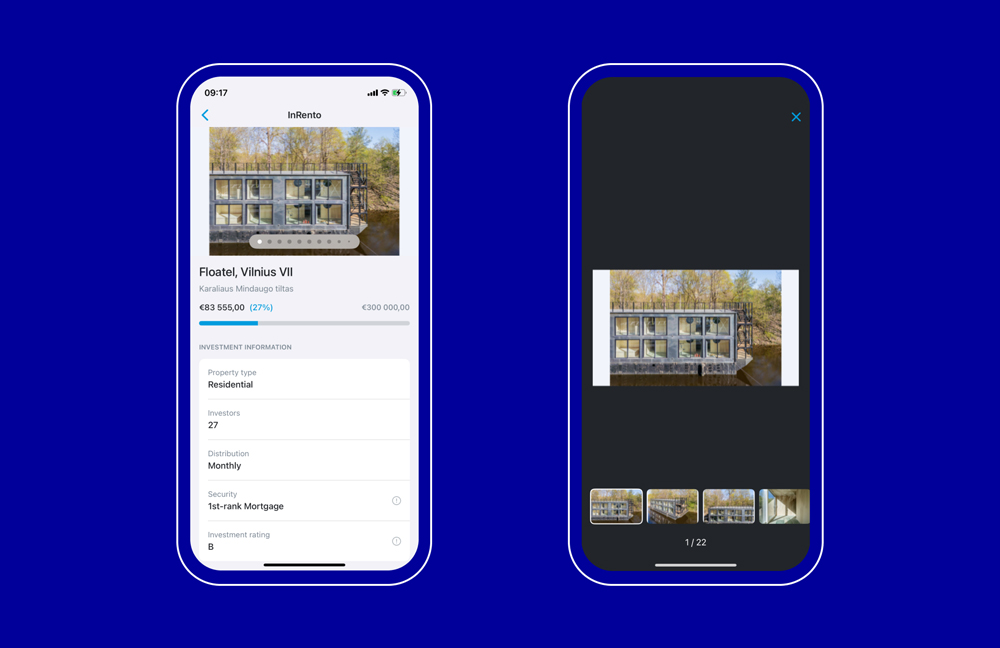

Don’t shy away from exploring it in more detail! Just tap on it and you’ll get all the information you need to make an informed decision, such as:

- security rank and investment rating;

- possible returns based on the amount you invest;

- information about the project owner, reasons to invest, potential risks, and more.

When you’re ready to invest

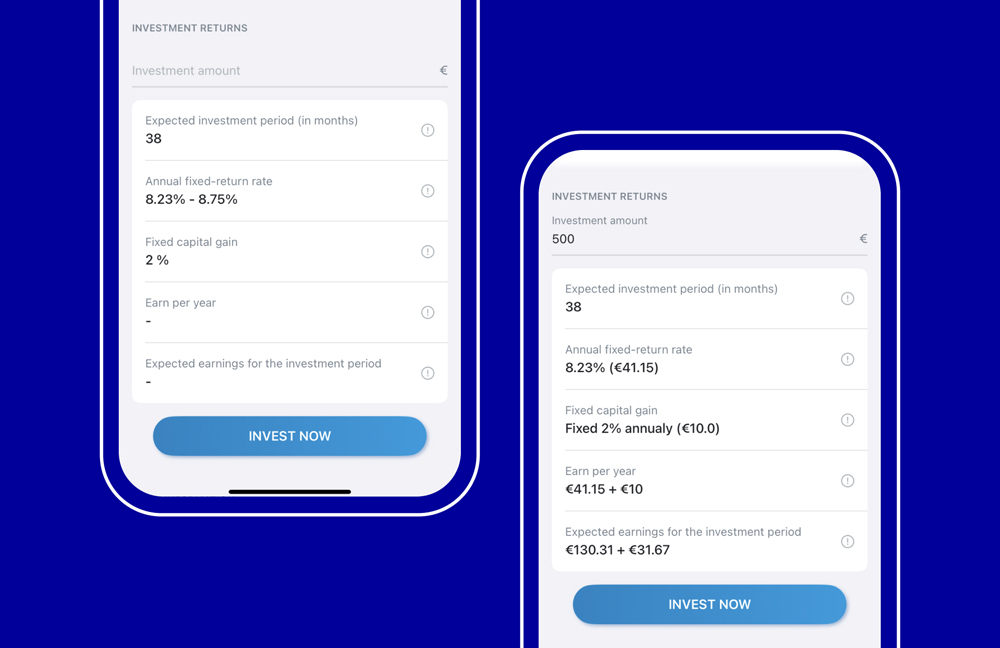

Tap on the specific project, then scroll to INVESTMENT RETURNS, type in the amount you want to invest (remember, the starting amount is 500 euros), and check the information carefully. If you find it acceptable, select INVEST NOW.

If you're new to investing with InRento, you'll need to fill out a questionnaire and agree to a risk agreement. You'll also need to agree to the Rules and Terms of Conditions.

If you've already invested with InRento before, completed the questionnaire, and agreed to the risk agreement, you won’t be asked to repeat the same procedure.

Once you invested in a project

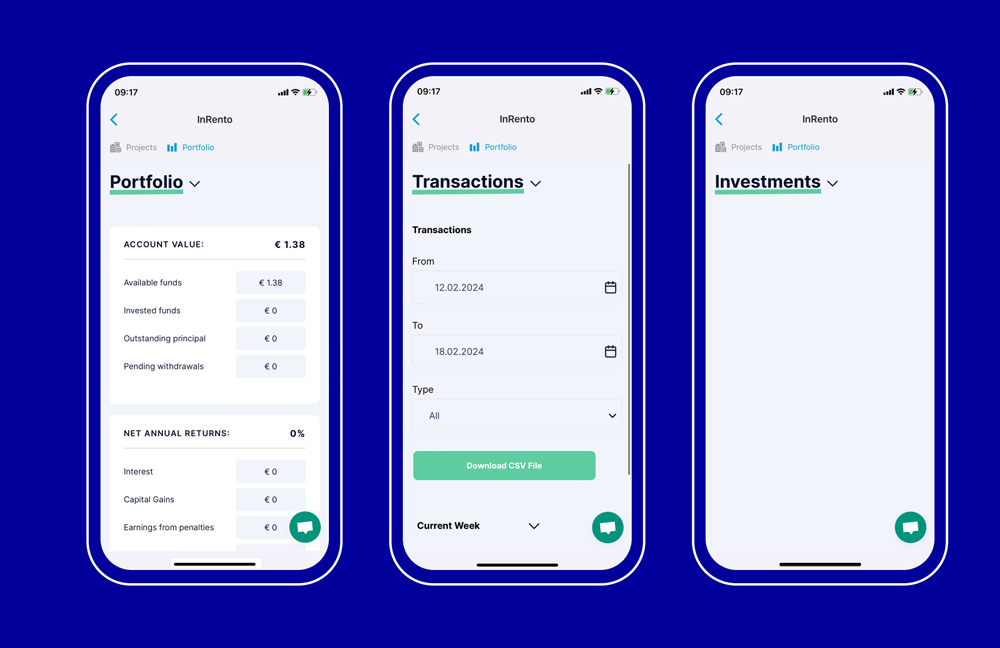

You can check your portfolio anytime you want. Just return to the main InRento section and next to the Projects section you’ll see Portfolio. Select it and you’ll find all the data about account value, net annual returns, and net monthly profit.

We’re here if you need help!

In case there’s something that we haven’t covered in this blog post and you couldn’t find it on the app – contact our client support team. We’ll be happy to help with this or any other questions you might have, just give us a call or write to us.